Toronto, Ontario (March 28, 2023) – Red Pine Exploration Inc. (TSXV: RPX, OTCQB: RDEXF) (“Red Pine” or the “Company”) is pleased to report new drilling results from its ongoing exploration program. The new results continue to indicate that broad zones of gold mineralization exist in the hanging wall of the Jubilee Shear in geological structures that were sparsely tested by historic drilling programs.

- Minto B Shear located above the Jubilee Shear

- Intersection of 3.50 g/t gold (or “Au”) over 25.15min SD-22-415 (Figure 3) that includes:

- High-grade gold in a quartz vein network transposed in the Minto B Shear that contains 36.48 g/t gold over 2.01 metres.

- Intersection of 4.63 g/t gold over 10.80 m, including 16.44 g/t Au over 2.50 m in SD-22-413 (Figure 2) (see February 16, 2023 press release)

- Intersection of 3.50 g/t gold (or “Au”) over 25.15min SD-22-415 (Figure 3) that includes:

- Extension of mineralized structures in the hanging wall of the Jubilee Shear (Figure 1)

- 1.37 g/t gold over 7.10 m including 5.02 g/t gold over 0.99 m and 4.41 g/t gold over 4.41 m in the Minto C Shear

Quentin Yarie, President and CEO of Red Pine Exploration commented:

“Our drilling results continue to demonstrate the presence of significant gold mineralization in geological structures above and below the Jubilee Shear, adding credence to our presumption of a revised resource that could include a shallow pit constrained resource. High grade gold bearing structures in the hanging wall are proving to be prolific and to further demonstrate continuity along strike with the peripheral materials also being mineralized with lower grade gold which has the potential to substantially increase our gold inventory.”

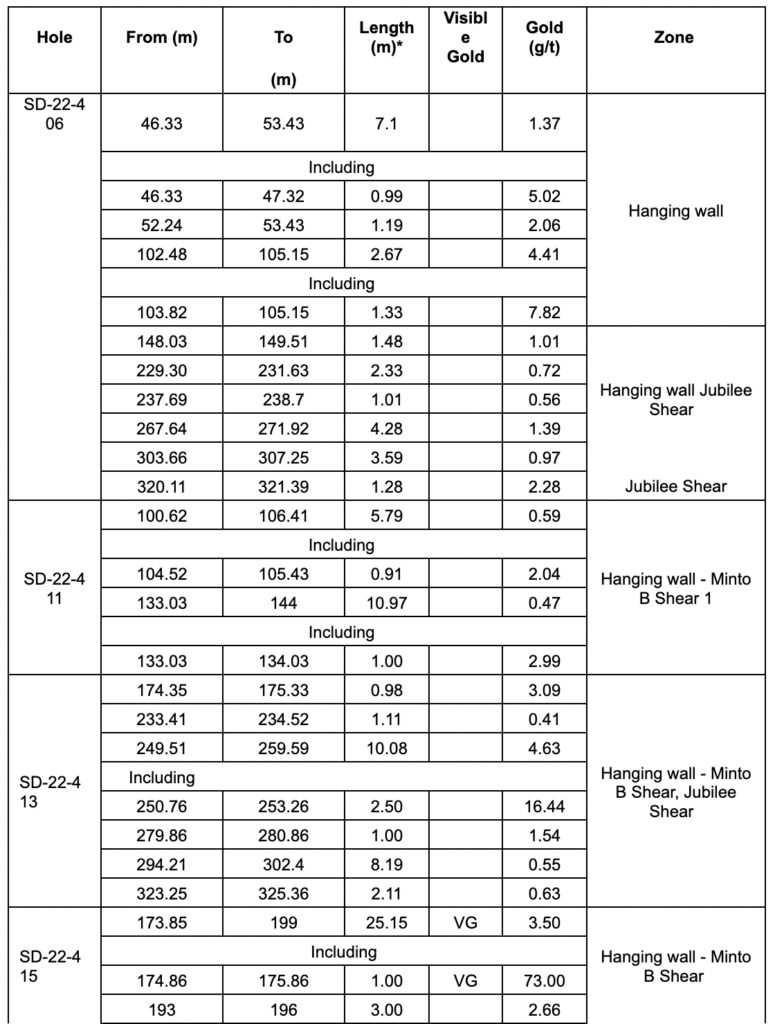

Table 1– Highlights from drilling in the Wawa Gold Corridor (Figure 1)

Assay results presented over core length. True width for the intersections varies between 55 to 90% depending on the intersected geological structure.

Pit Constrained Exploration Target

The Company has re-visited the option of an open pit constrained resource that would encompass most of the current underground constrained Surluga resources.

| Surluga Mineral Resource Estimate (August 18, 2021 – cut-off grade of 2.70 g/t Au) | |||

| Resource Category | Tonnes (000s) | Gold Grade (g/t) | Contained Gold (000 oz) |

| Total Indicated | 1,202 | 5.31 | 205 |

| Total Inferred | 2,362 | 5.22 | 396 |

This exploration target would also include the Hornblende Shear, the Minto B Shear, the recently identified extensional quartz vein networks, and intrusion-related gold in both the hanging wall and foot wall of the Jubilee Shear (host of the Surluga deposit). Figure 4.

Exploration Target Range (“ETR”) for an open pit-constrained resource ranges from ~1,200,000 ounces gold contained in ~20.5 million tonnes (“Mt”) at 1.80 grams per tonne (“g/t”) gold to ~1,600,000 oz Au contained in ~25 Mt at 2.0 g/t Au (Table 1). The exploration target range also exclude an underground constrained resource that could exist in the Jubilee and Minto Mine Shears beyond an open pit constrained resource.

Table 1 – Exploration Target Range* of an open pit constrained resource

| Tonnage: | 20.5 – 25 Mt |

| Gold Grade: | 1.8 – 2.0 g/t Au |

| Metal Content: | 1,200,000-1,600,000 oz Au |

| Cut-off Grade: | 0.4 – 0.5 g/t Au |

*The grade range of the exploration target is based on the current resources, historical and current assay data, structural mapping from surface and borehole data, and geological controls and has not undergone statistical analysis to determine if an appropriate grade capping methodology should be applied and is thus uncapped for Au concentrations.

The potential quantities and grades disclosed herein are conceptual in nature and there has been insufficient exploration to define a mineral resource for the open pit target disclosed herein. It is uncertain if further exploration will result in these target(s) being delineated as a mineral resource. The Company’s Qualified Person has not done sufficient work to classify the ETR as a current mineral reserve or mineral resource. The Company is not treating the ETR as a current mineral resource and the ETR should not be relied upon.

The process of assessing the ETR uses quantitative and qualitative approaches that integrate current and historical drillhole, geological, geophysical, and underground data with reasonable assumptions based on geological potential and deposit type model. Tonnage and grade ranges have been determined by using the geometry of the potential mineralized horizon defined by the current Surluga and Minto Mine South resources, historical drilling and downhole assay data and extrapolated with reasonable geological assumptions based on both underground, surficial geological, geochemical and geophysical data.

Quality Assurance/Quality Control (“QA/QC”) Measures

Drill core samples were transported in security sealed bags for analyses to Actlabs in Ancaster, Ontario. Individual samples were labelled, placed in plastic sample bags and sealed. Groups of samples were then placed into durable rice bags and shipped. The residual coarse reject portions of the samples remain in storage if further work or verification is needed.

Red Pine has implemented a quality-control program to comply with best practices in the sampling and analysis of drill core. As part of its QA/QC program, Red Pine inserts external gold standards (low to high grade) and blanks every 20 samples in addition to random standards, blanks, and duplicates.

Qualified Person

Quentin Yarie, P.Geo. and Chief Executive Officer of Red Pine and the Qualified Person, as defined by National Instrument 43-101, has reviewed, and approved the technical information contained in this news release.

About Red Pine Exploration Inc.

Red Pine Exploration Inc. is a gold exploration company headquartered in Toronto, Ontario, Canada. The Company’s shares trade on the TSX Venture Exchange under the symbol “RPX” and on the OTCQB Markets under the symbol “RDEXF”.

The Wawa Gold Project is in the Michipicoten Greenstone Belt of Ontario, a region that has seen major investment by several producers in the last five years. Its land package hosts numerous historic gold mines and is over 6,900 hectares in size. Led by Quentin Yarie, CEO, who has over 25 years of experience in mineral exploration, Red Pine is strengthening its position as a major mineral exploration and development player in the Michipicoten region.

For more information about the Company, visit www.redpineexp.com

Or contact:

Quentin Yarie, President and CEO, (416) 364-7024, qyarie@redpineexp.com

Carrie Howes, Director Corporate Communications, (416) 644-7375, chowes@redpineexp.com

1 National Instrument 43-101 Technical Report for the Wawa Gold Project, Brian Thomas P.Geo. Golder Associates Ltd, report effective August 18, 2021.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This news release contains statements which constitute “forward-looking information” within the meaning of applicable securities laws, including statements regarding the plans, intentions, beliefs and current expectations of the Company with respect to future business activities and operating performance.

Forward-looking information is often identified by the words “may”, “would”, “could”, “should”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” or similar expressions. Forward-looking information contained in this news release includes but may not be limited to:” the potential for a hybrid pit and underground project”. Investors are cautioned that forward-looking information is not based on historical facts but instead reflect management’s expectations, estimates or projections concerning future results or events based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made. Such opinions, assumptions and estimates are inherently subject to a variety of risks and uncertainties that could cause actual events or results to differ materially from those projected and undue reliance should not be placed on such information, as unknown or unpredictable factors could have material adverse effects on future results, performance or achievements. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking information are the following: the Company’s expectations in connection with the projects and exploration programs being met, the impact of general business and economic conditions, global liquidity and credit availability on the timing of cash flows and the values of assets and liabilities based on projected future conditions, fluctuating gold prices, currency exchange rates (such as the Canadian dollar versus the United States Dollar), variations in ore grade or recovery rates, changes in accounting policies, changes in the Company’s mineral reserves and resources, changes in project parameters as plans continue to be refined, changes in project development, construction, production and commissioning time frames, the possibility of project cost overruns or unanticipated costs and expenses, higher prices for fuel, power, labour and other consumables contributing to higher costs and general risks of the mining industry, failure of plant, equipment or processes to operate as anticipated, unexpected changes in mine life, seasonality and weather, costs and timing of the development of new deposits, success of exploration activities, permitting time lines, government regulation of mining operations, environmental risks, unanticipated reclamation expenses, title disputes or claims, and limitations on insurance.

This information is qualified in its entirety by cautionary statements and risk factor disclosure contained in filings made by the Company, including the Company’s annual information form, financial statements and related MD&A for the year ended July 31, 2022, and the interim financial reports and related MD&A for the period ended October 31, 2022, filed with the securities’ regulatory authorities in certain provinces of Canada and available at www.sedar.com.

Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking information prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Company has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update this forward-looking information except as otherwise required by applicable law.

Figure 1 – Location of the Minto B / Jubilee Triangle and the current drill hole collar locations from the Surluga Area

Figure 2 – Cross Section of hole SD-22-413 with the Minto B ./Jubilee Shears and the Gold found in the Hanging wall and Footwall of the Surluga Deposit

Figure 3 – Cross Section of hole SD-22-415 with the Minto B ./Jubilee Shears and the Gold found in the Hanging wall and Footwall of the Surluga Deposit

Figure 4 – Footprint of pit constrained Exploration Target

1 National Instrument 43-101 Technical Report for the Wawa Gold Project, Brian Thomas P.Geo. Golder Associates Ltd, report effective August 18, 2021.