rED Pine’s

Wawa Gold Project

Ontario, Canada

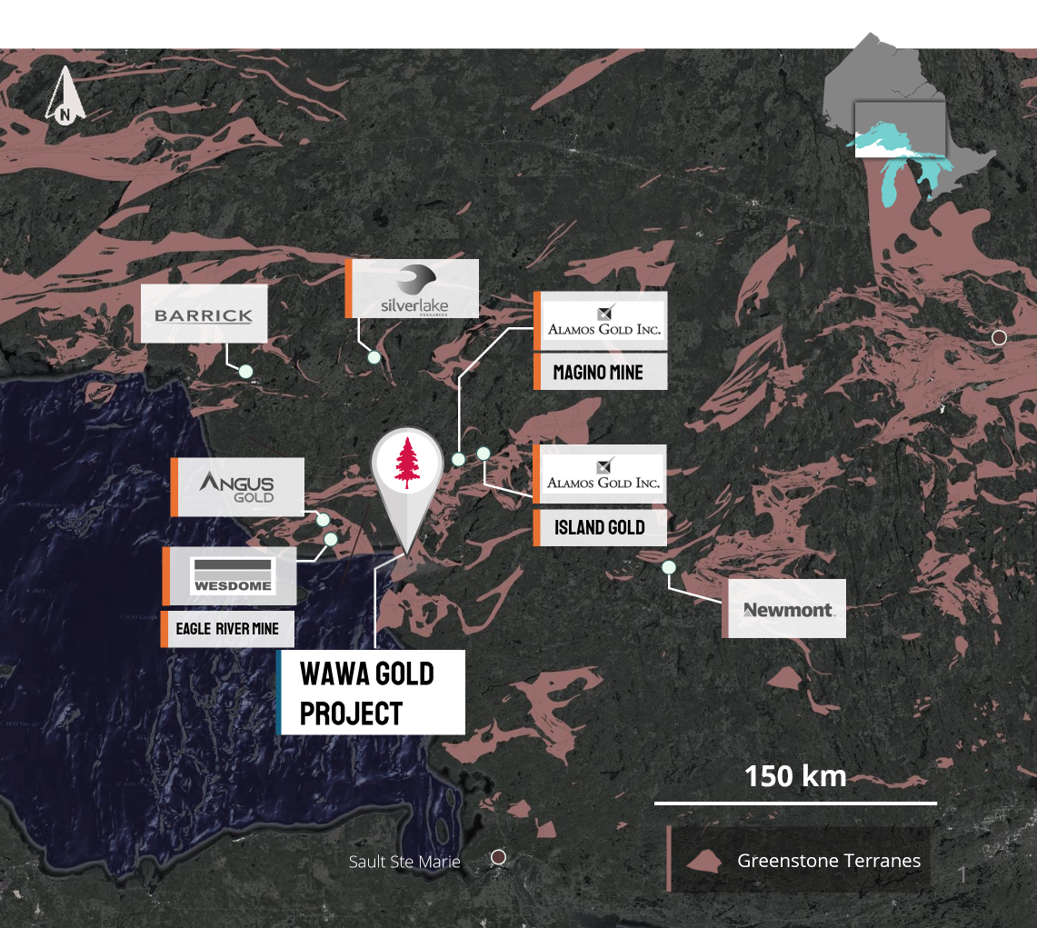

- Location: McMurray Township, 2 km southeast of the Town of Wawa, Ontario

- Size: 7,000+ hectares with 123 patents / leases and 307 mining claims

- Access: All weather road, access from highway 101

- Infrastructure: Brownfield property with numerous historical gold mines and underground infrastructure, on property living quarters and core shack

- Ownership: 100%

Nearby Locations

| Airport | 500 m West |

| Town of Wawa | 2 km west |

| Sault Ste Marie | 225 km North |

| Timmins | 330 km West |

Red Pine Announces Significantly Increased Mineral Resource for the Wawa Gold Project

The deposit is highlighted by continuous gold mineralization starting from surface and extending up to 1,200 metres down dip thus providing optionality for potential future open pit and underground development scenarios.

| Zone |

Category |

Resource |

Tonnes |

Grade (g/t Au) |

Ounces Gold |

|---|---|---|---|---|---|

| Jubilee* |

Indicated |

Open Pit |

14,354,000 |

1.72 |

794,000 |

| Jubilee* |

Inferred |

Open Pit |

14,718,000 |

1.40 |

665,000 |

| |

|||||

| Jubilee*/Minto |

Indicated |

Underground |

299,000 |

4.99 |

48,000 |

| Jubilee*/Minto |

Inferred |

Underground |

1,456,000 |

3.80 |

179,000 |

| |

|||||

| Total |

Indicated |

Open Pit/Underground |

14,653,000 |

1.79 |

842,000 |

| Total |

Inferred |

Open Pit/Underground |

16,183,000 |

1.62 |

843,000 |

*Jubliee Zone was previously the Surluga Deposit, which now includes a larger portion of the Jubliee Shear Zone and the Hanging Wall in the Open Pit Resource

*This graphic demonstrates the progression of the mineral resource at the Wawa Gold Project as at the effective dates of such mineral resource estimates shown on the x-axis of the graphic. Any mineral resource estimate other than the current 2024 MRE is (i) historic in nature, and (ii) being presented for illustrative purposes only and should not be relied upon.

1 National Instrument 43-101 Technical Report for the Wawa Gold Project, Brian Thomas P.Geo. WSP Ltd, Steve Haggarty, P.Eng., Haggarty Technical Services, report effective September 30, 2024.

1) The updated MRE described above has been prepared in accordance with the CIM Standards (Canadian Institute of Mining, Metallurgy and Petroleum, 2014) and follows Best Practices outlined by the CIM (2019).

2) Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. There are no Mineral Reserves for the Wawa Gold Project.

3) The “qualified person” (for purposes of National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101“)) for the updated MRE is Brian Thomas, P.Geo., an employee of WSP and is “independent” of the Company within the meaning of Section 1.5 of NI 43-101.

4) The effective date of the updated MRE is August 28, 2024.

5) A minimum thickness of 3 metres was used when interpreting the mineralized bodies.

6) The updated MRE is based on sub-blocked models with a main block size of 3 metres x 3 metres x 3 metres.

7) The pit-constrained Mineral Resources are reported at a 0.40 g/t Au cut-off grade considering an Operating Expense (“OPEX”) of CDN $28.95 / tonne ($2.70/t mining, $19.00/t processing, $3.10/t G&A, $3.80/t transport to mill, $0.35/t rehabilitation)

8) The Jubilee underground constrained Mineral Resources are reported at a 2.00 g/t Au cut-off and a minimum of 2,000 tonnes of contiguous material contained within a 1.60 g/t envelope. The 2.0 g/t cut-off assumes underground long hole mining with an OPEX of CDN $146.65 / tonne ($90.00 mining, $37.50 milling, $15.00 G&A, $3.80/t transport to mill, $0.35/t rehabilitation).

9) The Minto underground constrained Mineral Resources are reported at a 2.40 g/t Au cut-off and a minimum of 2,000 tonnes of contiguous material contained within a 2. 00 g/t envelope. The 2.40 g/t Au cut-off grade assumes underground long hole mining with an OPEX of CDN $176.65 / tonne ($120.00 mining, $37.50 milling, $15.00 G&A, $3.80/t transport to mill, $0.35/t rehabilitation).

10) A bulk density factor of 2.77 tonnes per cubic m (t/m3) was applied for the MRE.

11) A gold price of $CDN2,632 (US$1,950) per ounce as used, and a USD/CDN exchange rate of 1.35.

12) Mill recovery of 90.3% was assumed.

13) Royalty of 2.5% (reduced from 3.5% assuming expected re-purchasing of 1.5% of NSR from previous joint venture partner for $CDN1.75 million and option to purchase an additional royalty of 0.5% by Franco-Nevada upon completion of feasibility study).

14) As required by reporting guidelines, rounding may result in apparent summation differences between tonnes, grade, and metal content.

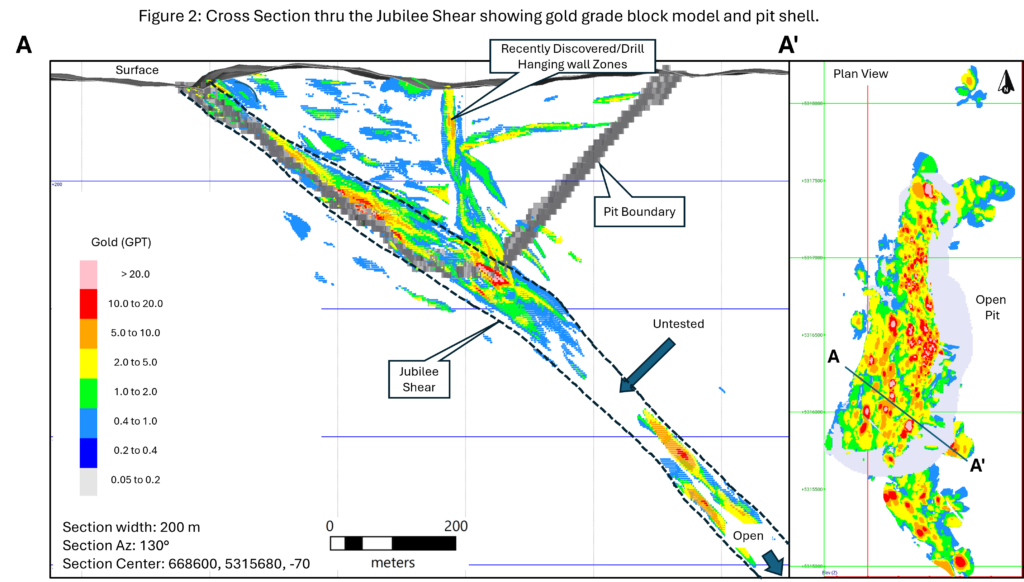

Vertical cross-section (looking north) showing Au grade block model

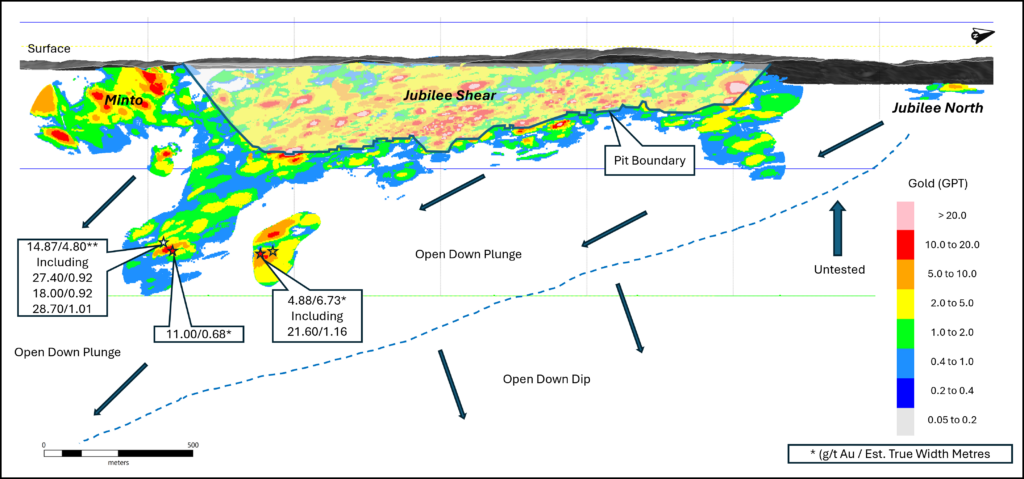

Longitudinal section (looking west) showing Au grade block model

Exploration Potential

- High-grade mineralization down dip and down plunge extensions of the Jubilee and Minto deposits as part of an underground mining scenario

- Expansion of lower grade mineralization located in the hanging wall of the Jubilee Shear and in the northern extension of the Jubilee Shear that would occur within an open pit scenario

- Numerous historic zones and high priority targets elsewhere on the Wawa Gold Project property

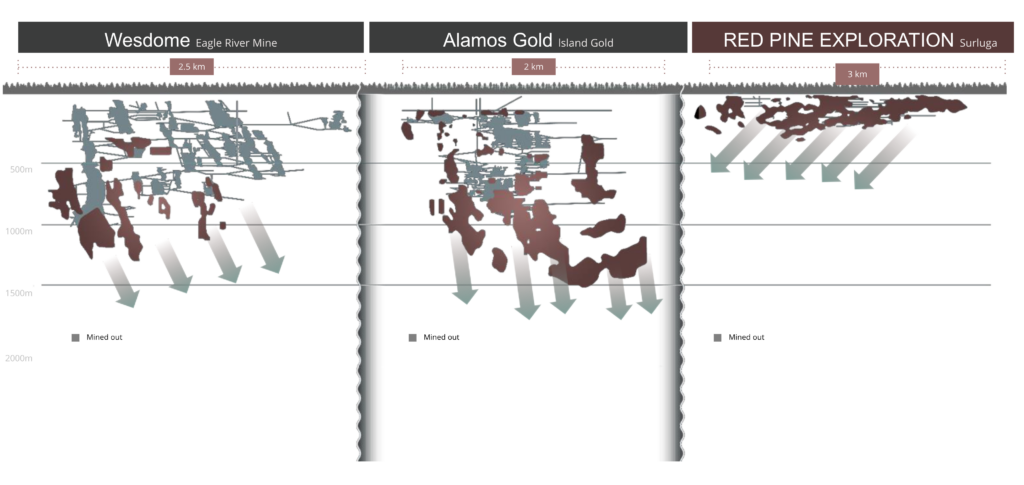

Comparative Evolution of Nearby Deposits

Excellent Infrastructure

Strong Relationship with First Nations and the Town of Wawa

Fully permitted for all exploration activities

with First Nations in place

Water sampling, tailing pond monitoring and drill site remediation

Red Pine Exploration published ESG report (Jan 16 2024)