Toronto, Ontario (August 28, 2024) – Red Pine Exploration Inc. (TSXV: RPX, OTCQB: RDEXF) (“Red Pine” or the “Company”) announces an updated independent Mineral Resource Estimate (“MRE”), inclusive of an open pit and underground Mineral Resource, prepared by WSP Canada Inc. (“WSP”) for the Company’s 100% owned Wawa Gold Project in Ontario.

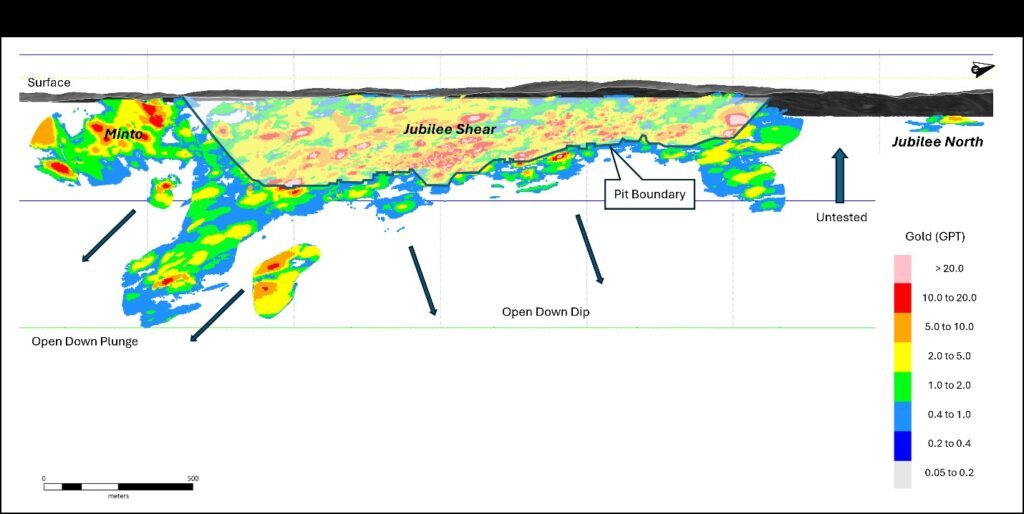

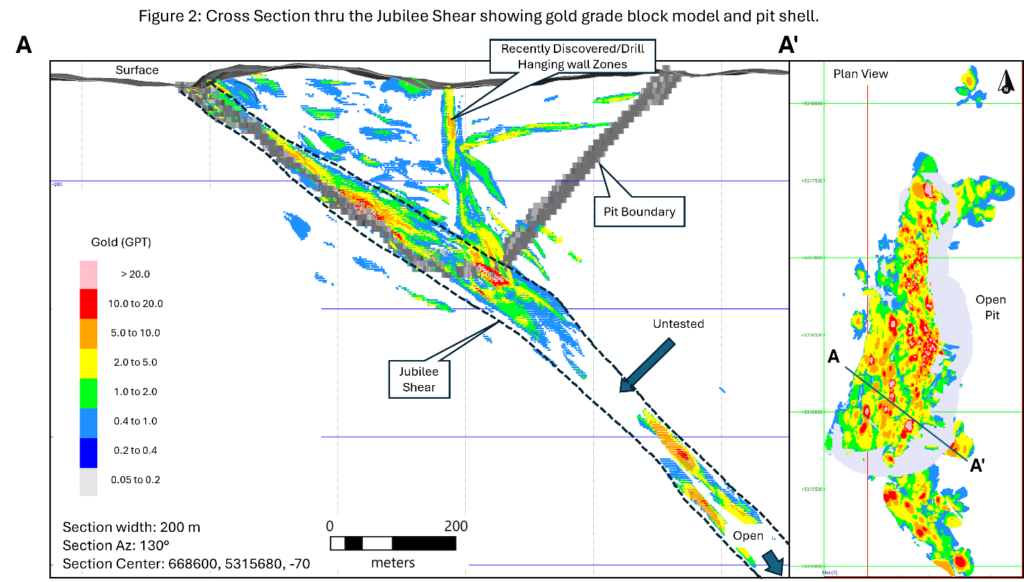

Highlights (Table 1 and Figures 1 to 2)

- The updated MRE has added significantly to the previous 2019 MRE, with an Indicated Mineral Resource of 14.7 million (“M”) tonnes grading 1.8 grams per tonne gold (“g/t Au”) containing 842,000 ounces of gold and an Inferred Mineral Resource of 16.2 M tonnes grading 1.6 g/t Au containing 843,000 ounces of gold, inclusive of both open pit and underground:

- Open Pit:

- Indicated Mineral Resource of 14.3 M tonnes grading 1.7 g/t Au containing 794,000 ounces of gold for the Jubilee deposit); and

- Inferred Mineral Resource of 14.7 M tonnes grading 1.4 g/t Au containing 665,000 ounces of gold.

- Underground:

- Indicated Mineral Resource of 299,000 tonnes grading 5.0 g/t Au containing 48,000 ounces of gold (including the Jubilee and Minto deposits); and

- Inferred Mineral Resource of 1.5 M tonnes grading 3.8 g/t Au containing 179,000 ounces of gold.

- The open pit Mineral Resource is constrained within a pit shell above a 0.40 g/t Au cut-off and the underground Mineral Resource is constrained above a 2.0 g/t Au cut-off for Jubilee and 2.4 g/t Au cut-off for Minto.

- The deposit is highlighted by continuous gold mineralization starting from surface and extending up to 1,200 metres down dip thus providing optionality for potential future open pit and underground development scenarios:

- High-grade mineralization will be the focus of the near-term exploration program, specifically the down dip and down plunge extensions of the Jubilee and Minto deposits as part of an underground mining scenario.

- The updated MRE shows clear potential for expansion of lower grade mineralization located in the hanging wall of the Jubilee Shear and in the northern extension of the Jubilee Shear that would occur within an open pit scenario.

- The updated MRE comprises a small portion of the Company’s land holdings and there remain numerous historic zones and high priority targets elsewhere on the Wawa Gold Project property.

Michael Michaud, President and CEO of Red Pine commented: “We are thrilled to see this increase of approximately 150% in total ounces of gold in the updated MRE. This significant increase validates the approximately 65,000 metres of strategic exploration drilling completed over the past several years. The updated MRE not only shows a material increase in the size of the deposit, but it also significantly increases our confidence in the data and the quality of the deposit and reinforces our vision for a potential high-quality open pit and sizeable higher-grade underground mine. This will provide optionality for any future potential development scenarios.

We believe the Mineral Resource we have defined today is just the beginning. The latest drill results not only highlight the potential of the Jubilee Shear to host significant gold mineralization over thick sections, but drilling has also confirmed that gold mineralization remains open laterally to the north, and both down dip and down plunge. Any future discoveries in these areas can add substantial value to the Wawa Gold Project, and as such, is a priority for near-term exploration drilling program.

There also remains numerous exploration targets across the Wawa Gold Project property that remain untested. We plan to include a portion of future drilling programs to test new targets with the intention of making new discoveries to further demonstrate the Wawa Gold Project property’s mineral wealth.”

Mineral Resource Estimate

Mineral Resources are not Mineral Reserves, and do not demonstrate economic viability. There is no certainty that all, or any part, of this Mineral Resource will be converted into Mineral Reserve. Inferred Mineral Resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves.

The updated MRE is set out in Table 1 below.

Notes:

- The updated MRE described above has been prepared in accordance with the CIM Standards (Canadian Institute of Mining, Metallurgy and Petroleum, 2014) and follows Best Practices outlined by the CIM (2019).

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. There are no Mineral Reserves for the Wawa Gold Project.

- The “qualified person” (for purposes of National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101“)) for the updated MRE is Brian Thomas, P.Geo., an employee of WSP and is “independent” of the Company within the meaning of Section 1.5 of NI 43-101.

- The effective date of the updated MRE is August 28, 2024.

- A minimum thickness of 3 metres was used when interpreting the mineralized bodies.

- The updated MRE is based on sub-blocked models with a main block size of 3 metres x 3 metres x 3 metres.

- The pit-constrained Mineral Resources are reported at a 0.40 g/t Au cut-off grade considering an Operating Expense (“OPEX”) of CDN $28.95 / tonne ($2.70/t mining, $19.00/t processing, $3.10/t G&A, $3.80/t transport to mill, $0.35/t rehabilitation)

- The Jubilee underground constrained Mineral Resources are reported at a 2.00 g/t Au cut-off and a minimum of 2,000 tonnes of contiguous material contained within a 1.60 g/t envelope. The 2.0 g/t cut-off assumes underground long hole mining with an OPEX of CDN $146.65 / tonne ($90.00 mining, $37.50 milling, $15.00 G&A, $3.80/t transport to mill, $0.35/t rehabilitation).

- The Minto underground constrained Mineral Resources are reported at a 2.40 g/t Au cut-off and a minimum of 2,000 tonnes of contiguous material contained within a 2. 00 g/t envelope. The 2.40 g/t Au cut-off grade assumes underground long hole mining with an OPEX of CDN $176.65 / tonne ($120.00 mining, $37.50 milling, $15.00 G&A, $3.80/t transport to mill, $0.35/t rehabilitation).

- A bulk density factor of 2.77 tonnes per cubic m (t/m3) was applied for the MRE.

- A gold price of $CDN2,632 (US$1,950) per ounce as used, and a USD/CDN exchange rate of 1.35.

- Mill recovery of 90.3% was assumed.

- Royalty of 2.5% (reduced from 3.5% assuming expected re-purchasing of 1.5% of NSR from previous joint venture partner for $CDN1.75 million and option to purchase an additional royalty of 0.5% by Franco-Nevada upon completion of feasibility study).

- As required by reporting guidelines, rounding may result in apparent summation differences between tonnes, grade, and metal content.

Technical Discussion

The Wawa Gold Project hosts several gold-bearing structures that, combined, form the Wawa Gold Corridor, a structure that extends for more than 6 kilometres. Since the last MRE in 2019, more than 65,000 metres of drilling has been completed to test near surface mineralization and to better define and extend the higher-grade portions of the Jubilee and Minto deposits. There is now more than 283 km of drilling completed on the Wawa Gold Project that includes resource definition drilling and the limited drill testing of the other exploration targets that are not included in the updated MRE.

Red Pine completed comprehensive data analysis to build high quality lithology, alteration, and structural models which fed the Company’s updated MRE domains and which will guide future exploration programs. The results support a robust open-pit and underground mine plan. The proportion of Indicated to Inferred Mineral Resources has increased substantially, as has our confidence in the data and updated MRE.

Future opportunities include additional metallurgical analysis to optimize mill recoveries as well as geotechnical analysis of core to determine the slope of the open pit walls to minimize waste development. Additional drilling has the potential to define near surface, lower-grade mineralization adjacent to, and in the hanging wall of, the Jubilee Shear to lower waste development in any open pit scenario.

Widely spaced gold intersections in both the Minto and Jubilee Shears, beyond the footprints of the updated MRE, indicate that the structures extend at depth and laterally, that they remain mineralized, and that additional drilling could further expand the Mineral Resource (Figures 1 and 2).

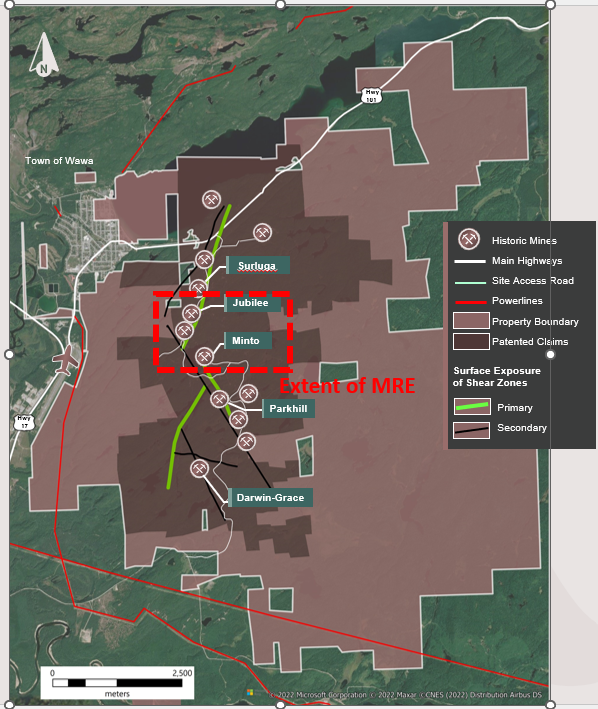

The Wawa Gold Corridor also includes many other gold-bearing structures and historic mines that remain under-explored, including Hornblende/IRG, Mackay Point Mine and northern extension of the Jubilee Shear, Parkhill-Van Sickle, Grace-Darwin, Copper-Ganley, Mariposa, etc. (Figure 3).

Conference Call

The Company will host a conference call at 10:00 a.m. E.T. on Wednesday, September 4, 2024, at which time Michael Michaud, President and Chief Executive Officer of Red Pine will present the findings set out in this press release.

The conference call can be accessed as follows:

Topic: Red Pine Exploration Webinar to Discuss Consolidated Mineral Resource

When: September 4, 2024 10:00 AM Eastern Time (US and Canada)

Please click the link below to join the webinar:

Passcode: 160005

Or One tap mobile :

+17193594580,,83894001082#,,,,*160005# US

+17207072699,,83894001082#,,,,*160005# US (Denver)

Or Telephone:

Dial (for higher quality, dial a number based on your current location):

+1 719 359 4580 US

+1 720 707 2699 US (Denver)

+1 253 205 0468 US

+1 253 215 8782 US (Tacoma)

+1 301 715 8592 US (Washington DC)

+1 305 224 1968 US

+1 309 205 3325 US

+1 312 626 6799 US (Chicago)

+1 346 248 7799 US (Houston)

+1 360 209 5623 US

+1 386 347 5053 US

+1 507 473 4847 US

+1 564 217 2000 US

+1 646 558 8656 US (New York)

+1 646 931 3860 US

+1 669 444 9171 US

+1 689 278 1000 US

Webinar ID: 838 9400 1082

Passcode: 160005

International numbers available: https://us06web.zoom.us/u/kejxkZ9fvj

Qualified Person

Brian Thomas, P.Geo. of WSP, is the qualified person, as defined by NI43-101, responsible for the preparation of the updated MRE. Jean-Francois Montreuil, P.Geo. Vice President, Exploration of Red Pine, also a qualified person, as defined by NI43-101, has reviewed and approved the technical information contained in this news release.

About Red Pine Exploration Inc.

Red Pine Exploration Inc. is a gold exploration company headquartered in Toronto, Ontario, Canada. The Company’s shares trade on the TSX Venture Exchange under the symbol “RPX” and on the OTCQB Markets under the symbol “RDEXF”.

The Wawa Gold Project is in the Michipicoten Greenstone Belt of Ontario, a region that has seen major investment by several producers in the last five years. Its land package hosts numerous historic gold mines and is over 7000 hectares in size. Red Pine is building a strong position as a mineral exploration and development player in the Michipicoten region.

For more information about the Company, visit www.redpineexp.com

Or contact:

Michael Michaud, President and CEO, at (416) 364-7024 or mmichaud@redpineexp.com

Carrie Howes, Director Corporate Communications, at (416) 644-7375 or chowes@redpineexp.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This news release contains statements which constitute “forward-looking information” within the meaning of applicable securities laws, including statements regarding the plans, intentions, beliefs and current expectations of the Company with respect to future business activities and operating performance.

Forward-looking information is often identified by the words “may”, “would”, “could”, “should”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” or similar expressions. Forward-looking information contained in this news release includes, but may not be limited to, the deposit providing optionality for potential future open pit and underground development scenarios; high-grade mineralization being the focus of the near-term exploration program; the potential for expansion of lower grade mineralization that would occur within an open pit scenario; the Company’s vision for a potential high-quality open pit and sizeable higher-grade underground mine that would provide optionality for any future potential development scenarios; future discoveries adding substantial value to the Wawa Gold Project; the Company’s plan to include a portion of future drilling programs to test new targets with the intention of making new discoveries to further demonstrate the Wawa Gold Project property’s mineral wealth; future opportunities including additional metallurgical analysis to optimize mill recoveries as well as geotechnical analysis of core to determine the slope of the open pit walls to minimize waste development; the potential of additional drilling to define near surface, lower-grade mineralization adjacent to, and in the hanging wall of, the Jubilee Shear to lower waste development in any open pit scenario; and the potential of additional drilling further expanding the Mineral Resource.

Investors are cautioned that forward-looking information is not based on historical facts but instead reflects management’s expectations, estimates or projections concerning future results or events based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made. Such opinions, assumptions and estimates are inherently subject to a variety of risks and uncertainties that could cause actual events or results to differ materially from those projected and undue reliance should not be placed on such information, as unknown or unpredictable factors could have material adverse effects on future results, performance or achievements. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking information are: the Company’s expectations in connection with the projects and exploration programs being met, the impact of general business and economic conditions, global liquidity and credit availability on the timing of cash flows and the values of assets and liabilities based on projected future conditions, fluctuating gold prices, currency exchange rates (such as the Canadian dollar versus the United States Dollar), variations in ore grade or recovery rates, changes in accounting policies, changes in the Company’s mineral reserves and resources, changes in project parameters as plans continue to be refined, changes in project development, construction, production and commissioning time frames, the possibility of project cost overruns or unanticipated costs and expenses, higher prices for fuel, power, labour and other consumables contributing to higher costs and general risks of the mining industry, failure of plant, equipment or processes to operate as anticipated, unexpected changes in mine life, seasonality and weather, costs and timing of the development of new deposits, success of exploration activities, permitting time lines, government regulation of mining operations, environmental risks, unanticipated reclamation expenses, title disputes or claims, and limitations on insurance.

This information contained in this news release is qualified in its entirety by cautionary statements and risk factor disclosure contained in filings made by the Company, including the Company’s financial statements and related MD&A for the year ended July 31, 2023, and the interim financial reports and related MD&A for the periods ended October 31, 2023, January 31, 2024 and April 30, 2024, filed with the securities’ regulatory authorities in certain provinces of Canada and available at www.sedar.com.

Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking information prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Company has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update this forward-looking information except as otherwise required by applicable law.

Figure 1: Longitudinal section (looking west) of the Jubilee Shear showing grade block model and open pit shell.

Figure 2: Vertical Cross section (looking north) of the Jubilee Shear showing grade block model and open pit shell.

Figure 3: Plan view of the property showing area of the Mineral Resource and other known gold zones.